Performance:

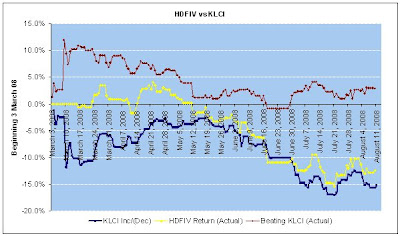

HDFIV is at the moment outperforming KLCI by 8.50% (30 Sept 08: 8.90%) at a loss of 24.32% (30 Sept 08: 14.54%) while KLCI suffered a loss of 32.82% (30 Sept 08: 23.44%). There was a dip in terms of performance during the month - bringing down our performance below KLCI's as IOI and Lion Industries had a major dip. Both stocks recovered and we are back on track in terms of outperforming KLCI.

Friday, November 7, 2008

HDFIV Report Card @ 7 Nov 08

Thursday, October 30, 2008

How You Should View Bad Financial News

Hey shareholders... will be updating our fund's performance soon. Will be away for eye laser operation tomorrow and hopefully eyesights return in time for me to update by next Monday.

Worried about endless bad financial news recently? Read on...

"Stock markets worlwide are crashing and reaching historical lows...", so you turn on the television to catch the latest market news, so you flip pages of business sections to check how the market is doing or so you hear colleagues talk about not the right time to buy. But instead of logging to CNBC or CNN, imagine that you can tune in to Benjamin Graham Financial Network ("BGFN"). By the way, Benjamin Graham was a great teacher to Warren Buffett. On BGFN, the audio doesn't capture the famous sour clang of the market's closing bell; the video doesn't home in on brokers scrurrying across the trading floor of stock exchanges like angry dogs. Nor does BGFN run any footage of fund managers telling how bad the market is going to be in the next few months.

Instead, the image that fills your TV screen is the facade of the KLCI, festooned with a huge banner reading: "SUPER SALE! 50% OFF". A promoter girl announces brightly, "Stocks became more attractive yet again today, as the KLCI dropped another 5% on heavy selling volume - the third day in a row that stocks have gotten cheaper. Plantation investors fared even better, as leading companies like IOI Plantation Berhad lost another 10% on the day, third consecutive day of 10% drop, making them even more affordable. That comes on top of the good news of the past year, in which stocks have already lost half of its value, putting them at bargain levels not seen in years. And some prominent analysts from big houses like CIM Bank are optimistic that prices may drop still further in the next few months with their sell calls."

The newscast cuts over to top market strategiest, Mr Top Market Strategist of Top Research Firm, who says "My forecast is for stocks to lose another 15% by year end. I'm cautiously optimistic that if everything goes well, stocks could lose 30%, maybe more."

"Let's hope Mr Top Market Strategist is right," the newscaster says cheerily. "Falling stock prices would be fabulous news for any investor with longer time horizon."

(The above article was modified based on an article in page 222 of "The Intelligent Investor, The Definitive Book on Value Investing")

Thursday, October 2, 2008

Tuesday, September 30, 2008

HDFIV Report Card @ 30 Sept 08

Performance:

Performance:

HDFIV extended its run on outperforming KLCI by 8.90% (22 Sept 08: 8.39%) at a loss of 14.54% (22 Sept 08: 14.40%) while KLCI suffered a loss of 23.44% (22 Sept 08: 22.79%. The outperformance is partly contributed by the additional capital of RM6,600 for month of Oct 08, demonstrating the power of cost of averaging and continuous investment on constant basis. I have added a new bar graph for "cash position over net asset value" with reading on the right axis.

I was watching CNBC yesterday night on the debate by the House of Representatives in US over the pros and cons of the financial-rescue plan of USD700 billion. However, I was too tired and fell asleep, only to discover that the rescue plan has been voted down at vote of 228 to 205. Investors in US became jittery and as a result Dow Jones dropped by 777 points, apparently a historical record. This morning, our KLCI followed negatively by dropping by more than 20 points but recovered at the end of the day.

Portfolio:

We talked about incorporating short term trading strategy in our portfolio strategy last week. To reiterate, this short term trading strategy ("STTS") is basically to take advatange of choppy price movements but SUBJECT to (a) our fund size which has been relatively big in view of the 8th period; and (b) prices we go in for the trading has to make sense in terms of fundamental (a price that we are prepared to hold or can cost average our current investment).

This week, as part of the SSTS, we have bought 1,600 units of IOI Corporation Berhad at RM4.20 with targeted short term selling price at RM4.50-RM4.60 within contra period. As mentioned, the price we enter into has to make sense in terms of value. By buying 1,600 units at RM4.20, we have also averaged out our cost per share to RM5.05 from RM6.40 (21% lower). So, we have flexibilities in terms of make small and quick gain or continue to hold for longer term with lower cost per share.

During the week, we have also acquired 3,500 units of Lion Industries Berhad at RM1.38 per unit. Lion Industries Berhad is a steel player in Malaysia and a valuation done by OSK Investment Bank Berhad has build my interest in the stock. Will talk about the counter in another article but very quickly, here is an extraction of the valuation:

Profit from steel business for year ended June 2008 (price earnings of 4.8 times) = RM3,463 million

Total investment in Lion Forest Industries, Parkson Holdings Berhad, Lion Diversified Holdings Berhad = RM1102 million and by putting a conservative discount of 40%, the total investment in these listed companies are worth RM661 million.

By adding the profit from steel business and investments in listed companies, the company is worth RM4,124 million or RM5.75 per share.

Will await for next financial plan by US. I am of the view that that the USD700 billion plan which has been voted down will be finetuned as the US financial market can't afford to continue to be in the dire situation it is in now.

Monday, September 22, 2008

HDFIV Report Card @ 22 Sept 2008

Performance:

HDFIV is currently beating KLCI by 8.39% (15 Sept 08: 6.96% at a loss of 14.40% (15 Sept 08: 15.96%) while KLCI suffered a loss of 22.79% (15 Sept 08: 22.47%. KLCI dropped below 1,000 points last week and managed to rebound with plantation sectors playing a major role.

Our fund has managed to widen the gap with KLCI's performance with IOI's price rebounding due to stronger CPO price.

Portfolio:

We did a minor reshuffling of portfolio to take advantage of our relatively larger fund size. We will allocate a small portion of our fund for short term trading to take advantage of prices yo-yoing in the uncertain market. Downside of such strategy is of course limited as the prices that we are going in are still attractive in terms of value. We have bought 1,500 units of BJTOTO at RM4.38, averaging down our cost per unit from RM4.74 to RM4.50 (10% cheaper) and at the sametime raising our exposure on BJTOTO from 10% to 28% of our fund. We have also disposed of 1,400 units of IOI at RM4.60 with losses of RM467. We are willing to realised loss as the strategy is to sweep back the stock at at lower price with expected profits to be made. This is a short term trading strategy deployed to take advantage of price movements but subject to (1) our fund is relatively big to be able to allocate a small percentage for shor term trading; and (2) prices we go in for short term trading has to make sense in terms of fundamental.

Asset Allocation:

Cash remained at about 20% after our portfolio reshuffling to incorporate short term trading strategy.

Strategy:

Generally, in my opinion, the investors are pretty tired with the political development. In fact, if Datuk Seri Anwar Ibrahim is unable to topple the Governement by his self-imposed deadlines, guess the market might settle down with some short term stability. Market will be very much driven by development in the US. At the time of writing, Dow Jones IA and regional markets have been showing positive results due to the huge plan by the Government to save the dying investment banks in the US.

We have cash and will continue to average down our holdings.

Monday, September 15, 2008

HDFIV Report Card @ 15 Sept 2008

Strategy:

Friday, September 5, 2008

HDFIV Report Card @ 5 Sept 2008

Performance:

HDFIV is currently beating KLCI by 7.80% (29 Aug 08: 5.79%) at a loss of 11.75% (29 Aug 08: 11.50%) while KLCI suffered a loss of 19.55% (27 Aug 08: 17.29%). KLCI continued its downtrend as Dow Jones Industrial Average suffered a 300 over points drop as well as the political uncertainties that have yet to see any light at the end of the tunnel. Our fund has managed to extend our gap with KLCI's performance with the contribution of our holdings that have been holding relatively steady during the week as well as the dilution of losses from our monthly cash inflow.

Portfolio:

No purchases and sales this week.

Asset Allocation:

Cash increased to about 20% from 7% after the monthly cash inflow.

Strategy:

With the exciting date i.e. 16 Sept 08 around the corner, we would prefer to stay on the sideline during this period. We are not timing the market but waiting for opportunity to sweep some cheap stocks if KLCI happened to react badly on political developments. Stocks under radar are Resorts World and Bursa Securities.

Monday, September 1, 2008

HDFIV Report Card @ 29 August 2008

Performance:

HDFIV is currently beating KLCI by 5.79% (27 Aug 08: 5.50%) at a loss of 11.50% (27 Aug 08: 12.91%) while KLCI suffered a loss of 17.29% (27 Aug 08: 18.41%). KLCI recovered about 20 plus points on Friday ahead of the announcement of Budget 2009.

Portfolio:

No purchases and sales this week.

Asset Allocation:

7% cash (27 Aug 08: 7% cash).

Strategy:

Our holdings are registering single digits losses except for Bursa and Waseong-Wa. Next immediate strategy is to acquire new cheap stocks or to average out Bursa. Bursa remained top pick in view of its cash hoard and simple business model.

Wednesday, August 27, 2008

EPF a Contrarian Like Us?

Stumbled upon this article in the Edge Weekly written by Kathy Fong. It was titled "EPF ups stakes in plantation companies".

According to Kathy, the EPF appears to be contrarian in terms of stock picking on Bursa Malaysia lately. Although many probably think that buying plantation stocks, which are currently undergoing a sharp correction, is a little like catching a falling knife. The EPF, however, is pouring money into plantation counters. The recent decline in CPO prices does not seem to worry it.

Sounds like what HDFIV is doing? The recent decline in CPO prices does not worry us too. In the article itself, the managing director Gerald Amrbose from Aberdeen Asset Management Snd Bhd also made a comment that is very in line with HDFIV's strategy. He said "Over the long term, we've made the point that the supply of edible oil will be limited because of scarcity of agriculture land. If it becomes alternative fuel, we are not just eating it but also burning it. But it is just that there are little bubbles resulting in some uncertainties in the shor term."

However, as a fund management company, Aberdeen Asset Management have shorter term investment horizon and concerned about possible excess supply when th eworld economy slows down, the rising fertiliser costs that eat into planters' margin and changes in policy on biofuel in some European countries amid inflation worries.

Majority of research houses in Malaysia have downgraded the plantation sectors and stocks under coverage. Again, not a concern to us because I can guarantee the houses will upgrade them when CPO goes up.

Friday, August 22, 2008

HDFIV Report Card @ 22 August 2008

Performance:

HDFIV is currently beating KLCI by 5.50% (20 Aug 08: 4.24%) at a loss of 12.91% (20 Aug 08: 15.11%) while KLCI suffered a loss of 18.41% (20 Aug 08: 19.34% ). Crude palm oil price rebounded as well of recoveries of commodities prices in the United States propelled KLCI slightly higher. IOI was the top performer in the fund this week with recovery from RM4.80 to RM5.15.

Portfolio:

No purchases or sales this week.

Asset Allocation:

Staying at 7% cash (20 Aug 08: 7% cash)

Strategy:

Brokers and remisiers revealed that funds are buying back into IOI Corporation Berhad after the massive sell down that caused the share price of IOI to drop from RM8.00 plus to RM4.00 plus. Reason is the higher crude palm oil price. Now people, investors, speculators are looking at crude palm oil hitting RM3,000 per tonne again. Such development is very short term based for simple reason - movement in daily crude palm oil does not have immediate impact on the operational and financial performance of IOI as the company may be able to hedge prices if they want or leave it exposed. But what is happening is investors are reacting to movement of crude palm oil and make buy and sell decisions of IOI stock based on movement in crude palm oil.

In other words, the increase in crude palm oil may not be sustainable in three days time (for example) and after three days, buyers might dump IOI stock if crude palm oil decreases again.

We will just have to take advantage of these movements and continue to accumulate stocks when it's below our cost as we believe crude palm oil is a commodity with no real substitute in the world. Further, any increase in crude oil will make crude palm oil viable for biodisel as well, creating another source of demand for crude palm oil. And I am wondering when CIMB Research will start to come back with another buy call with "increase in crude palm oil price" as one of the key re-rating catalyst.

Wednesday, August 20, 2008

HDFIV Report Card @ 20 Aug 2008

Performance:

HDFIV is currently beating KLCI by 4.24% (8 Aug 08: 2.87%) at a loss of 15.11% (8 Aug 08: 12.81%) while KLCI suffered a loss of 19.34% (8 Aug 08: 15.69%). No sight of recoveries in KLCI's performance. Key concerns remained as global economies moving into recession (or already have) as well as the political uncertainties in Malaysia.

Portfolio:

No new purchases or disposals this week. IOI announced its quarterly results this week. Summary of results are available in next article.

Asset Allocation:

7% cash.

Strategy:

KLCI is currently at 1,000-1,100 level but we have underweighted on cash. We will continue to acquire battered stocks with monthly cash inflow. Current unrealised loss is not a main concern due constant inflow of funds. For a simple illustration, current loss of 15.11% can be easily averaged down to 7% with the cash inflow of RM30k plus in the next six months. That is excluding interest income on the cash deposits. Many would argue that KLCI is still heading downwards and now is not the right time to buy. Question back to them is how low before we should start buying? More often than that, proponents of "You should not buy now!" will start buying at higher than our costs as they will only start to buy when KLCI starts to trend up. No doubt, profits can be made as KLCI is trending upwards but these proponents will continue to practise buying at higher price with profit taking (after making minimal profits). Of course, they will argue that they have proper loss cutting mechanisms in place etc.

Don't think we will be able to stop arguing if I continue to write about different strategies adopted by different practitioners. Our fund style is simple - buy when no one is buying (as you can see now) and sell when everyone is selling (which you will see later as in 2-3 or even 4-5 years down the road). If KLCI drops to 800 points, we will still be smiling as our cash coffer is replenishable on a monthly basis, providing us continuous bullets to tackle the market.

Monday, August 11, 2008

Listen to Research Analyst! Or Should You Not?

On 26 February 2008, CIMB Research issued a Trading Buy call with target price of RM10.00. IOI Corporation Berhad ("IOI")'s share was trading at RM8.05. A Trading Buy means the stock's total return is expected to exceed a relevant benchmark's total return by 5% or more over the next 3 months. The target price of RM10.00 is approximately 24% over its current price of RM8.05. In fact, the target price has been upped from RM9.40 to RM10.00 based on a forward price to earnings ratio of 24 times. KLCI was trading at

1,375.43.

In the same report, CIMB Research has also raised their international CPO price forecasts by 10% to USD1,045 per tonne for 2008, and by 15% to USD1,060 for 2009. Local Malaysian CPO price is expected to go up by 9% to RM3,150 per tonne for 2008 and RM2,900 per tonne for 2009.

On 11 March 2008 (after the general election's results), IOI dropped to RM6.65. KLCI was trading at 1,206.54 (down by 12% from 1,375.43). Now, wondering what is the target price now? Well, it's RM8.30, down from RM10.00 (down by 17%). Reasons quoted for the lowered target price are (a) downgrade in overall market price to earnings ratio following poor showing by incumbent government during the recent general election (b) a weaker outlook for the property sector as confidence in the sector will be eroded by political uncertainty and weak stock market performances, and (c) risks of additional taxes on the planters if government delays price increases on certain controlled items.

Note that the downgrade in target price was amongst others DUE TO WEAK STOCK MARKET PERFORMANCE. The price to earnings for IOI has been cut from 24 times to 20 times. In other words, at 24 times PE, the target price is RM10.00. At 20 times PE, the target price is RM8.30. What say you if you have heed the call and bought in at RM8.05? And interestingly, the buy call was also supported by CPO price uptrend and potential acquisitions.

On 18 April 2008, KLCI was trading at 1,267.82 (recovered slightly from the 11 March 2008's selldown). IOI has recovered to RM7.30. CIMB Research continued to yell a call with price target of RM8.20. Key supporting for the call are CPO price uptick and potential M&As.

On 29 May 2008, Dato' Yeo How, the group's executive director of finance and corporate affairs resigned. IOI was trading at RM7.10 and the price target is now RM8.40. Key share price triggers including rising CPO price and potential M&As. KLCI was trading at 1,261.82.

On 16 July 2008, the buy call that has been yelled all this while has been toned down to Neutral, meaning the stock's return is expected to be within +/- 5% of a relevant benchmark's total return. IOI is now trading at RM6.50 and the target price has now been revised down to RM7.80. Well, no more mention of rising CPO price... in less than a month's time. KLCI was trading at 1,119.42 (dropped by 11% from 29 May 2008's level)

Best part is on 18 July 2008 when IOI was trading at RM6.10 and KLCI was at 1,105.04 (further drop from 16 July 2008), CIMB has now downgraded the price from RM7.80 to RM6.50! One of the reason is CPO price to peak this year!!!! Key re rating catalysts are softening CPO price, lower crude oil price and higher than expected operating costs.

As you can see in the chart below, the CPO price was trading at above RM3,500 on 29 May 2008 and CIMB Research expects the CPO price to continue to rise. My big question is why is that within two months time, the target price has been cut by a huge RM2! As can be seen in the chart again, not only that the CPO price did not rise significantly but instead has started it's decreasing trend to about RM2,800 plus today.

I have always been a keen reader of CIMB Research's report. However, it just doesn't make any sense when buy and sell calls are made based on KLCI movement. When market is good, PE of 24 times are pegged but when market is trending down, PE was slashed to 20 times. So, what if naive uncle and auntie investors follow your call? Shouldn't your analyst is good enough to predict that CPO price is already peaking at RM3,500? Why is that your analyst still forecasted a rising CPO price when market was doing well but then talked about CPO price peaking when market is on downtrend? Would the price target stays at RM10.00 if market where to trade at above 1,300 level?

In the end, should we listen to you or not? Buy calls when market is good and sell calls when market is down. Any fundamentals? Sounds to me like your rationale was 'created' to justify your buy and sell call, depending on market movements rather than the other way round where you make the call based on fundamentals irregardless of market movements.

HDFIV Report Card @ 8 August 2008

Performance:

HDFIV is currently beating KLCI by 2.87% at a loss of 12.81% while KLCI suffered a loss of 15.69%. KLCI continued to be weighed down by slump in global economies as well as the political uncertainties in Malaysia.

Portfolio:

We have averaged out our cost in IOI Corporation Berhad via additional purchase of 1,400 units at RM4.88. Average cost has been brought down to RM5.63 from RM6.60. We continue to adopt the stance in accumulating this plantation stock which have been battered down from it's high for the year at RM8.60 (in 15 January 2008) - a decrease of 43%. 1 month and 3 months high were recorded at RM6.7 and RM7.65 respectively.

Asset Allocation:

Cash position dropped from 24% to 7% after our investment in IOI Corporation Berhad.

Strategy:

We have been taking a very contrarian approach so far with regards to our investments, especially in Bursa Malaysia Berhad and IOI Corporation Berhad. Research houses have been calling for a sell on these stocks and naturally the stock prices have reacted by trending downwards. We have been ignoring these calls and these calls are basically made on 12 months basis and have been very market-based. Check out a coming article on a recent analysis of a research house buy and sell call on IOI.

Wednesday, August 6, 2008

How to Fully Utilise a Bank's Products

A Chinese man walks into a bank in New York City and asks for the loan officer. He tells the loan officer that he is going to China on business for two weeks and needs to borrow $5,000.

The bank officer tells him that the bank will need some form of security for the loan, so the Chinese man hands over the keys to a new Ferrari parked on the street in front of the bank. He produces the title and everything checks out.

The Loan officer agrees to accept the car as collateral for the loan. The bank's president and its officers all enjoy a good laugh at the Chinese for using a $250,000 Ferrari as collateral against a $5,000 loan.

An employee of the bank then drives the Ferrari into the bank's underground garage and parks it there.

Two weeks later, the Chinese returns, repays the $5,000 and the interest, which comes to $15.41.

The loan officer says, 'Sir, we are very happy to have had your business, and this transaction has worked out very nicely, but we are a little puzzled. While you were away, we checked you out and found that you are a multi-millionaire. What puzzles us is why you would bother to borrow $5,000? The Chinese replies: 'Where else in New York City can I park my car for two weeks for only $15.41 and expect it to be there safely when I return.'

Friday, August 1, 2008

HDFIV Report Card @ 8 August 2008

Performance:

HDFIV is currently beating the KLCI 2.63% at at loss of 10.26% while KLCI suffered 12.89%. Dividend declared by both Bursa and Public Bank of 16.5% and 30.0% of par value respectively.

Porfolio:

No additions or disposals of stocks this week.

Cash position increased from 15% to 24% with monthly contribution.

Strategy:

Will continue to monitor prices of existing holdings for cost averaging.

Monday, July 28, 2008

HDFIV Report Card @ 28 July 2008

Performance:

Porfolio:

We have managed to accumulate stocks in gaming, banking, stock exchange, oil and gas as well as plantation over the past few months. 40% of our porftfolio lies in Public Bank Berhad, the bank that has solid track record over the years in terms of generating profits and providing returns via dividend and capital growth.

Asset Allocation:

We have been on a monthly basis accumulating stocks or averaging out purchases. Cash remains at 15% at the moment since it is near month end. Cash coffer expected to increase in month August 2008 with new contributions.

Strategy:

The decision to include volatile stocks such as Bursa in the porffolio will result in volatility in our portfolio's return. Further, any rise or fall in KLCI will have direct impact on our portfolio as all our holdings except for Wah Seong warrants are KLCI components. However in the event KLCI rebounds, we stand to reap the gain. Such volatility is mitigated with the benefits of monthly inflow. We will keep to our strategy of stock accumulation at various levels of prices. Fear is still greatly felt in the market at the moment due to political uncertainties. That is why we are accumulating despite calls from analysts and research houses to sell or hold.

Wednesday, July 16, 2008

What Warren Thinks...

Happened to stumble upon an article (http://money.cnn.com/2008/04/11/news/newsmakers/varchaver_buffett.fortune/) by Fortune on what Warren Buffett thinks about the current economy, the credit crisis and much more.

Have quoted a few FAQs from the article which I felt are meaningful:

Q: I know you had a paper route. Was that your first job?

A: Well, I worked for my grandfather, which was really tough, in the [family] grocery store. But if you gave me the choice of being CEO of General Electric or IBM or General Motors, you name it, or delivering papers, I would deliver papers. I would. I enjoyed doing that. I can think about what I want to think. I don't have to do anything I don't want to do. It might be wonderful to be head of GE, and Jeff Immelt is a friend of mine. And he's a great guy. But think of all the things he has to do whether he wants to do them or not.

Seane Lynch: Warren doesn't or probably never aspire to be a CEO of a very complex company. His whole life is spent on doing what he really likes and do at best - investment.

Q: How do you get your ideas?

A: I just read. I read all day. I mean, we put $500 million in PetroChina. All I did was read the annual report. [Editor's note: Berkshire purchased the shares five years ago and sold them in 2007 for $4 billion.]

Seane Lynch: Warren can just read annual reports, talk to management and close a deal with a price he sees right. That easy?

Q: What should we say to investors now?

A: The answer is you don't want investors to think that what they read today is important in terms of their investment strategy. Their investment strategy should factor in that (a) if you knew what was going to happen in the economy, you still wouldn't necessarily know what was going to happen in the stock market. And (b) they can't pick stocks that are better than average. Stocks are a good thing to own over time. There's only two things you can do wrong: You can buy the wrong ones, and you can buy or sell them at the wrong time. And the truth is you never need to sell them, basically. But they could buy a cross section of American industry, and if a cross section of American industry doesn't work, certainly trying to pick the little beauties here and there isn't going to work either. Then they just have to worry about getting greedy. You know, I always say you should get greedy when others are fearful and fearful when others are greedy. But that's too much to expect. Of course, you shouldn't get greedy when others get greedy and fearful when others get fearful. At a minimum, try to stay away from that.

Q: By your rule, now seems like a good time to be greedy. People are pretty fearful.

A: You're right. They are going in that direction. That's why stocks are cheaper. Stocks are a better buy today than they were a year ago. Or three years ago.

Q: But you're still bullish about the U.S. for the long term?

A: The American economy is going to do fine. But it won't do fine every year and every week and every month. I mean, if you don't believe that, forget about buying stocks anyway. But it stands to reason. I mean, we get more productive every year, you know. It's a positive-sum game, long term. And the only way an investor can get killed is by high fees or by trying to outsmart the market.

Seane Lynch: So, you think the Malaysian economy is going to do fine? If yes, should you go into stocks now?

Monday, July 14, 2008

Where Are We?

High inflation due to rising food prices and oil. Economy growth is slowing down and major countries in the world are heading towards recession. You can call that stagflation. Construction and properties industries are basically bleeding to death soon with rising material costs like steel, cements, bricks and transportation costs. The rakyat are not having enough disposable income to live a normal life. Our government is busy hurling allegations against the opposition. You bombed a pitiful Mongolian lady, shout the opposition. You poked a pitiful young lad's ass, shout the government. Now I declare, now I don't declare (because I am under duress when I declared).

Here we are. Trapped in a rubble worst than those caused by a 9 magnitude earthquake.

From the day we started our fund i.e. 1 March 2008, KLCI has since dropped 14%. Our fund, as expected, also suffered a drop in value by about 10%. Key point here is to continue to be able to outperform the KLCI. We are now outperforming KLCI by 4% as of last Friday. We have 30% in the form of cash (approximately RM10,000) and have the benefit of cashinflow every month. We can easily average out some of our cost of investment but the strategy now is to keep the proportion intact, adopt a defensive stance while monitoring the political situation. Stocks are cheap at the moment but as mentioned, we will retain the RM10,000 cash.

Friday, May 23, 2008

Financial Teasers 22 May 08

Top Stories

Moody's retains law firm to review CPDO ratings process

In response to a recent Financial Times article, Moody's has retained law firm Sullivan & Cromwell to do an external review of the agency's process for rating European constant proportion debt obligations. Moody's had rated complex debt products higher than warranted because of a glitch in its computer models but did not fix the error for nearly a year, despite senior staff knowledge. Meanwhile, U.S. Sen. Charles Schumer, D-N.Y., has called on the SEC to investigate the situation. Financial Times (21 May.)

Dark pools work to prevent "gaming," catch perpetrators

Both broker-dealer-owned and independent dark pools are getting tough on "gaming," or the use of trade information by another party for financial gain. The potential problem intensifies as more liquidity flows into the dark pools. Tabb Group estimated that at least 10% of daily volume is running through dark pools. A Tabb report from last year found that 60% of buy-side participants surveyed said the gaming threat affected their decision on whether to interact with the pools. Financial News Online (22 May.)

Canadian court ruling could derail buyout of BCE

The Quebec Court of Appeal ruled that bond holders of BCE were unfairly treated when the company's board of directors approved a $52 billion buyout offer from the Ontario Teachers' Pension Plan and its partners. BCE and its proposed buyers said they plan to appeal the lower-court ruling to the Supreme Court of Canada. Attorney John Finnigan, who is representing the bond holders, said if BCE and the buyout group want the deal to be completed, they will have to start over. Canada.com (CanWest News Service) (22 May.)

Group warns about liquidity battle in energy contracts

The Futures and Options Association warns that if the looming fight between IntercontinentalExchange and the New York Mercantile Exchange regarding control of liquidity in energy contracts heats up, London's energy market could get burned. The exchanges, along with LCH.Clearnet, are battling over competing clearing services. The FOA is concerned that the liquidity will be split between clearinghouses, raising regulatory issues. Financial Times (21 May.)

Auction-rate securities leave investors in a bind

Investors of auction-rate securities are facing the dilemma of either waiting for the market to get back on track or find a way to get their money back. Individuals' financial situation plays a large part in the decision. Those who can afford to leave the money might be rewarded with higher yields, while those who need the money now will likely have to pay either interest on a loan from their brokerage or take a discount and allow their adviser to buy the securities.

Bloomberg (22 May.)

Oil price hits more than $135 a barrel in Asia

In Asia, oil reached a record high price of more than $135 a barrel today and then retreated. Concerns about supply, increasing global demand and a declining dollar are keeping crude futures moving up. Analysts are starting to question what will stop oil prices from increasing as they continue to set new records almost daily. Although there are technical indications in the futures market that crude might drop, few analysts are ready to call an end to the rally. ClipSyndicate/Bloomberg (22 May.)

, Associated Press (22 May.)

Asian governments deal with record oil prices differently: While some Asian governments are subsidizing fuel costs for consumers to keep inflation in check, others are raising energy prices to reduce the impact on their budgets. "We see fiscal positions deteriorating in countries that subsidize the local cost of oil," said Robert Subbaraman, chief economist at Lehman Brothers Asia. "If oil prices stay persistently high at these levels, these kinds of measures can do more damage than good." Bloomberg (22 May.)

NRG Energy makes $11.3 billion bid for struggling rival

Calpine, a troubled power wholesaler with dual headquarters in Houston and San Jose, Calif., has revealed that its rival NRG Energy made an unsolicited bid of roughly $11.3 billion in stock. NRG, which confirmed the offer, is attempting the takeover only months after Calpine emerged from operating under bankruptcy protection. Associated Press (22 May.)

Market Activity

Japanese, Australian shares up despite oil concerns

Shares in Tokyo and Sydney, Australia, shrugged off a global slump in equity markets to reverse earlier losses and finish the day with gains. Tokyo's Nikkei increased 0.4% and Sydney's S&P/ASX 200 edged up 0.1%. Meanwhile, South Korea's Kospi and China's Shanghai Composite both slid 0.7%, Hong Kong's Hang Seng Index dropped 2% and Taiwan's Weighted Price index fell 0.4%. Singapore's Straits Times Index and Indonesia's Jakarta Composite both fell as well, 1.1% and 1.4%, respectively. MarketWatch (22 May.)

Credit crisis spurs derivatives market's rapid expansion

The Bank for International Settlements said in a report that the market for derivatives expanded 44% to $596 trillion from 2006 to 2007, the fastest expansion in at least a decade. The market, which includes derivatives on debt, commodities, currencies, interest rates and stocks, was spurred by the global credit crisis as many used the contracts to hedge against losses. ClipSyndicate/Bloomberg (22 May.) , Bloomberg (22 May.)

Most Brazilian companies cancel, postpone IPOs

With nearly two-thirds of last year's new stocks in Brazil losing money, most of the country's companies planning initial public offerings have either canceled or postponed their plans. Banco Fibra, PST Eletronica, Norse Energy do Brasil and more than a dozen other companies in Brazil, which has the best-performing equity market in the world, have delayed or withdrawn IPOs this year. Bloomberg (21 May.)

Economics

Experian: U.K. better positioned to weather storm than U.S.

Experian, the biggest credit information agency in the world, said U.K. banks started tightening lending standards two years ago, putting Britain in a better position to ride out the financial crisis than the U.S. Experian CEO Don Robert said the quality of credit portfolios in the U.K. is holding up, while the company has seen the housing market woes spread to credit cards and other areas of the market, resulting in "real evidence of the weakening consumer in the U.S." Telegraph (London) (22 May.)

Japan's trade surplus drops by more-than-expected 46.3%

Falling exports to the U.S. combined with the rising cost of energy imports caused the trading surplus in Japan to plunge 46.3% in April. The figure underscores the pressure that Japan is facing caused by the global economic downturn, analysts said. Increased shipments to rapidly expanding emerging markets are helping. Channel NewsAsia/Agence France-Presse (22 May.)

Iceland's central bank expected to boost or hold interest rate

Nine economists surveyed by Bloomberg expect the Central Bank of Iceland to either raise its benchmark interest rate today or hold it steady. The bank is struggling to reverse significant decline in the country's currency, the krona, and curb inflation, which is accelerating at its fastest pace in 18 years. Last week, central banks from three other Nordic countries offered to provide emergency funding to prop up Iceland's currency and financial system. Bloomberg (22 May.)

Geopolitical/Regulatory

Influential group calls for pan-EU "super regulator"

A group of former European premiers and finance ministers has sent an open letter to the European Commission and European Union president criticizing the financial industry and calling for an EU-wide regulator to prevent future crises. The letter takes aim at bankers' compensation, risk taking by financial institutions, lack of transparency in the markets and loss of business ethics. Telegraph (London) (22 May.)

Financial Products

Study predicts issuance of CDOs will likely disappear

A report by Aite Group predicts that the market for collateralized debt obligations is headed for oblivion. Data show that $226 billion worth of CDOs backed by asset-backed securities were issued two years ago. So far in 2008, only $1.5 billion worth of the CDOs have been issued. "As capital has become more dear, credit rationing, particularly applied to mortgages, has become de rigueur at lending institutions," said John Jay, the report's author. "With less collateral to securitize into CDOs and no ready buyers in sight, ABS CDO issuance has virtually disappeared." FinancialWeek (21 May.)

PowerShares launches first ETFs of ETFs

The PowerShares Autonomic Global Asset Portfolios are the first exchange-trade funds of ETFs. The three funds track indexes of ETFs developed by New Frontier Advisors, a Boston advisory firm. They were launched this week on the American Stock Exchange. The funds represent different risk levels and asset allocation strategies. Index Universe (20 May.)

Ethics

Judge: SEC lacks authority to fine advisers who aid, abet fraud

A ruling by the District Court in Washington might make it more difficult for the SEC to fine financial advisers found guilty of aiding and abetting fraud. After finding Robert Radano guilty for the illegal activity, District Judge Colleen Kollar-Kotelly said under the Investment Advisers Act of 1940, the SEC does not have the authority to fine Radano. "What the judge is saying is that the statutory language to fine adviser aiders and abettors is not in the Advisers Act," said Jane Stafford, managing member of Stafford & Associates. InvestmentNews (19 May.)

Tuesday, May 20, 2008

Financial Teasers 20 May 08

Top Stories

U.S. cuts use of imported oil for first time since '70s

The U.S. has seen its dependency on imported oil dip for the first time since 1977. Imports comprised 57.9% of oil consumption in the first three months of the year, down from 58.2% last year. Americans are using less because of high prices and because more ethanol is in use, said Guy Caruso, head of the U.S. Energy Information Administration. Financial Times (19 May.)

Microsoft targets Yahoo's search advertising operation

In its renewed romance of Yahoo, Microsoft has proposed several ideas for a pairing, including a revenue-sharing partnership and Yahoo selling its search advertising operation. Yahoo is under pressure to negotiate some kind of partnership or deal after resisting Microsoft's earlier buyout offer. Yahoo's future might depend on reaching a decision to sell or outsource some of its advertising business, Stifel Nicolaus analyst George Askew said. Microsoft has made it clear that it plans to build its search advertising business one way or another. San Jose Mercury News (Calif.) (19 May.)

Buffett keeps eyes on Europe for takeover targets

Investor Warren Buffett said he's concentrating on Europe, not emerging markets, for companies that his Berkshire Hathaway might be interested in buying. "You want to fish in a pond where the fish are, and Europe is a much better pond," he said. Buffett is on a four-city European tour designed to form relationships that might identify purchase targets for his investment and holding company. Bloomberg (19 May.)

Study: Quantitative fund managers must reassess models

These are tough days for quantitative fund managers. A study by the CFA Institute released last week found that a reliance on similar market factors has made it hard for many quant managers to generate returns. "If your model uses only public information, then everyone else has the same insights," said Michael O'Brien, head of European distribution at Barclays Global Investors. "Quant managers have traditionally taken their insights from the world of academia, but in the future they will have to rely less on this." The study found a need for managers to "update models continuously." FinancialWeek (20 May.)

Big consumer predicts platinum price will keep rising

One of the world's biggest users of platinum foresees a further 15% price increase in the next six months. Metals and chemicals group Johnson Matthey said global platinum output fell 4.1% in 2007, creating a shortage. That is likely to worsen this year as South African mines suffer disruptions because of the country's severe electricity disruptions. Financial Times (19 May.)

Alternative energy projects large and abundant

Forbes.com has identified the biggest and boldest projects that the world has seen so far. They include a geothermal project tapping into the volcanic heat below Indonesia; solar arrays in Australia and California's Mojave Desert; and wind farms in the Texas panhandle and off the coasts of England and Norway. Financial Post (Canada) (16 May.)

Japan expects to come out victorious in credit crisis

While other developed countries cope with the troubling ripples of the credit crisis, domestic and overseas markets should drive a recovery in Japan by the end of this year. Most Japanese financial institutions avoided exposure to subprime loans and dodged the worst of the fallout. Japan will also benefit as the falling dollar forces exporters to diversify their markets away from the U.S. China became Japan's largest export partner last year, and sales to Russia and oil-producing countries in the Middle East are strong. Telegraph (London) (20 May.)

Market Activity

Lack of news lowers Asian markets

Asian stock markets sank Tuesday as investors turned cautious in the absence of market-moving news. Hong Kong led the declines, with the Hang Seng Index down 1.8% after China Mobile reported lower-than-expected growth in telephone subscribers. MarketingWeek (subscription required) (20 May.)

U.K.'s gap in bond yields creates doubt about inflation fight

Investors appeared skeptical of the Bank of England's ability to fight inflation rising at its fastest rate in more than a decade. The gap has widened in recent months between the yields on index-linked U.K. government bonds and conventional bonds. The broader gap shows that bond investors want to pay increasingly higher prices for inflation protection. ClipSyndicate/Bloomberg (20 May.) , Financial Times (19 May.)

Economics

In unanimous decision, Bank of Japan holds interest rates

After dropping its growth outlook, the Bank of Japan decided Tuesday to keep interest rates steady. The overnight lending rate in Japan, at 0.5%, is the lowest among the world's major economies. "There are no options for the Bank of Japan other than to adopt a policy status quo," said Yasunari Ueno, chief market economist at Mizuho Securities. "It won't raise rates until around July next year at the earliest. At the same time, we don't expect a cut." ClipSyndicate/Bloomberg (19 May.) , International Herald Tribune/Bloomberg (20 May.)

Aussie dollar peaks on possible interest rate hike

The Australian dollar punched to a 24-year high Tuesday against the U.S. currency when traders priced in expectations of a coming interest rate hike by the Reserve Bank of Australia. Records of the RBA's May meeting showed that central bank policymakers discussed raising a key cash rate to fight inflation that is at a 17-year high. The Sydney Morning Herald (20 May.)

Brazilian president vows to fight rising inflation

Brazilian President Luiz Inacio Lula da Silva said the government will fight accelerating inflation. Economists predicted that consumer prices will jump to 5.12% this year, a central bank survey shows. Brazil's central bank is expected to raise its key interest rate by a half percentage point to 12.25% at its meeting June 3-4. Bloomberg (19 May.)

Geopolitical/Regulatory

U.S. change to global accounting standards could jolt

The widely expected U.S. adoption of international financial reporting standards could lead companies to dress up their bottom line. Of about 130 companies reconciling accounts from foreign filers using IFRS in 2006, 63% increased their earnings over GAAP reporting by a median 11.1%, according to a study by accounting analyst Jack Ciesielski. The most frequent differences were in the accounting for pensions, share-based compensation and derivatives, his analysis found. FinancialWeek (19 May.)

Nigeria to reform state oil company into private firm

Nigeria's president said the country's dominant and corrupt state oil company will be turned into an efficient private business once a reform process finishes sometime next year. President Umaru Yar'Adua heads a committee whose proposals on restructuring Nigerian National Petroleum Co. are expected in a couple of weeks. Nigeria is the world's eighth-largest oil producer, and the product is the country's main foreign currency earner. Agence France-Presse (18 May.)

Egypt says no tax is coming to reassure investors

Egyptian officials said they have no plans to impose a capital gains tax, hoping the reassurance will stop a slide in stock markets of more than 10% since the start of last week. The plunge came after President Hosni Mubarak announced new tax measures to raise US$2.6 billion for a 30% pay raise for public employees. Investors said the government failed to communicate its intentions, creating fear that more steps were coming and the sell-off of Egyptian shares. Financial Times (20 May.)

Financial Products

Gold in high demand despite decreased production

At the same time that gold production has dropped to its lowest in five years, demand by investors is booming. Demand for gold exchange-traded funds doubled from the first quarter of 2007, the World Gold Council said. MarketWatch (20 May.)

S&P starts new agribusiness composite index

Standard & Poor's has created a composite index that tracks both global agribusiness companies and farm commodities. S&P's Global Agribusiness Composite Index meshes subindexes based on crops and livestock with its agribusiness equities tracker. The new model will be less volatile, the company said. Structured Products (19 May.)

Ethics

SEC sues former AOL execs over inflated ad revenue

Eight former AOL executives overstated online advertising revenue by $1 billion, the Securities and Exchange Commission said in a lawsuit against them. The allegedly inflated revenue increased AOL's stock price, allowing it to buy Time Warner in 2000 for $184 billion to form the world's largest media company. The merged company's market capitalization has now fallen to about $56 billion. Four of the executives agreed to settle with the SEC without admitting or denying the allegations and to disgorge a total of $8 million. Forbes (19 May.)