Performance:

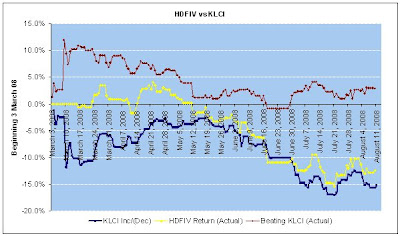

HDFIV is currently beating KLCI by 2.87% at a loss of 12.81% while KLCI suffered a loss of 15.69%. KLCI continued to be weighed down by slump in global economies as well as the political uncertainties in Malaysia.

Portfolio:

We have averaged out our cost in IOI Corporation Berhad via additional purchase of 1,400 units at RM4.88. Average cost has been brought down to RM5.63 from RM6.60. We continue to adopt the stance in accumulating this plantation stock which have been battered down from it's high for the year at RM8.60 (in 15 January 2008) - a decrease of 43%. 1 month and 3 months high were recorded at RM6.7 and RM7.65 respectively.

Asset Allocation:

Cash position dropped from 24% to 7% after our investment in IOI Corporation Berhad.

Strategy:

We have been taking a very contrarian approach so far with regards to our investments, especially in Bursa Malaysia Berhad and IOI Corporation Berhad. Research houses have been calling for a sell on these stocks and naturally the stock prices have reacted by trending downwards. We have been ignoring these calls and these calls are basically made on 12 months basis and have been very market-based. Check out a coming article on a recent analysis of a research house buy and sell call on IOI.

No comments:

Post a Comment