Stumbled upon this article in the Edge Weekly written by Kathy Fong. It was titled "EPF ups stakes in plantation companies".

According to Kathy, the EPF appears to be contrarian in terms of stock picking on Bursa Malaysia lately. Although many probably think that buying plantation stocks, which are currently undergoing a sharp correction, is a little like catching a falling knife. The EPF, however, is pouring money into plantation counters. The recent decline in CPO prices does not seem to worry it.

Sounds like what HDFIV is doing? The recent decline in CPO prices does not worry us too. In the article itself, the managing director Gerald Amrbose from Aberdeen Asset Management Snd Bhd also made a comment that is very in line with HDFIV's strategy. He said "Over the long term, we've made the point that the supply of edible oil will be limited because of scarcity of agriculture land. If it becomes alternative fuel, we are not just eating it but also burning it. But it is just that there are little bubbles resulting in some uncertainties in the shor term."

However, as a fund management company, Aberdeen Asset Management have shorter term investment horizon and concerned about possible excess supply when th eworld economy slows down, the rising fertiliser costs that eat into planters' margin and changes in policy on biofuel in some European countries amid inflation worries.

Majority of research houses in Malaysia have downgraded the plantation sectors and stocks under coverage. Again, not a concern to us because I can guarantee the houses will upgrade them when CPO goes up.

Wednesday, August 27, 2008

EPF a Contrarian Like Us?

Friday, August 22, 2008

HDFIV Report Card @ 22 August 2008

Performance:

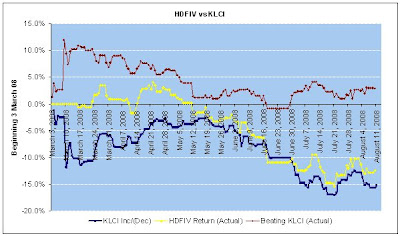

HDFIV is currently beating KLCI by 5.50% (20 Aug 08: 4.24%) at a loss of 12.91% (20 Aug 08: 15.11%) while KLCI suffered a loss of 18.41% (20 Aug 08: 19.34% ). Crude palm oil price rebounded as well of recoveries of commodities prices in the United States propelled KLCI slightly higher. IOI was the top performer in the fund this week with recovery from RM4.80 to RM5.15.

Portfolio:

No purchases or sales this week.

Asset Allocation:

Staying at 7% cash (20 Aug 08: 7% cash)

Strategy:

Brokers and remisiers revealed that funds are buying back into IOI Corporation Berhad after the massive sell down that caused the share price of IOI to drop from RM8.00 plus to RM4.00 plus. Reason is the higher crude palm oil price. Now people, investors, speculators are looking at crude palm oil hitting RM3,000 per tonne again. Such development is very short term based for simple reason - movement in daily crude palm oil does not have immediate impact on the operational and financial performance of IOI as the company may be able to hedge prices if they want or leave it exposed. But what is happening is investors are reacting to movement of crude palm oil and make buy and sell decisions of IOI stock based on movement in crude palm oil.

In other words, the increase in crude palm oil may not be sustainable in three days time (for example) and after three days, buyers might dump IOI stock if crude palm oil decreases again.

We will just have to take advantage of these movements and continue to accumulate stocks when it's below our cost as we believe crude palm oil is a commodity with no real substitute in the world. Further, any increase in crude oil will make crude palm oil viable for biodisel as well, creating another source of demand for crude palm oil. And I am wondering when CIMB Research will start to come back with another buy call with "increase in crude palm oil price" as one of the key re-rating catalyst.

Wednesday, August 20, 2008

HDFIV Report Card @ 20 Aug 2008

Performance:

HDFIV is currently beating KLCI by 4.24% (8 Aug 08: 2.87%) at a loss of 15.11% (8 Aug 08: 12.81%) while KLCI suffered a loss of 19.34% (8 Aug 08: 15.69%). No sight of recoveries in KLCI's performance. Key concerns remained as global economies moving into recession (or already have) as well as the political uncertainties in Malaysia.

Portfolio:

No new purchases or disposals this week. IOI announced its quarterly results this week. Summary of results are available in next article.

Asset Allocation:

7% cash.

Strategy:

KLCI is currently at 1,000-1,100 level but we have underweighted on cash. We will continue to acquire battered stocks with monthly cash inflow. Current unrealised loss is not a main concern due constant inflow of funds. For a simple illustration, current loss of 15.11% can be easily averaged down to 7% with the cash inflow of RM30k plus in the next six months. That is excluding interest income on the cash deposits. Many would argue that KLCI is still heading downwards and now is not the right time to buy. Question back to them is how low before we should start buying? More often than that, proponents of "You should not buy now!" will start buying at higher than our costs as they will only start to buy when KLCI starts to trend up. No doubt, profits can be made as KLCI is trending upwards but these proponents will continue to practise buying at higher price with profit taking (after making minimal profits). Of course, they will argue that they have proper loss cutting mechanisms in place etc.

Don't think we will be able to stop arguing if I continue to write about different strategies adopted by different practitioners. Our fund style is simple - buy when no one is buying (as you can see now) and sell when everyone is selling (which you will see later as in 2-3 or even 4-5 years down the road). If KLCI drops to 800 points, we will still be smiling as our cash coffer is replenishable on a monthly basis, providing us continuous bullets to tackle the market.

Monday, August 11, 2008

Listen to Research Analyst! Or Should You Not?

On 26 February 2008, CIMB Research issued a Trading Buy call with target price of RM10.00. IOI Corporation Berhad ("IOI")'s share was trading at RM8.05. A Trading Buy means the stock's total return is expected to exceed a relevant benchmark's total return by 5% or more over the next 3 months. The target price of RM10.00 is approximately 24% over its current price of RM8.05. In fact, the target price has been upped from RM9.40 to RM10.00 based on a forward price to earnings ratio of 24 times. KLCI was trading at

1,375.43.

In the same report, CIMB Research has also raised their international CPO price forecasts by 10% to USD1,045 per tonne for 2008, and by 15% to USD1,060 for 2009. Local Malaysian CPO price is expected to go up by 9% to RM3,150 per tonne for 2008 and RM2,900 per tonne for 2009.

On 11 March 2008 (after the general election's results), IOI dropped to RM6.65. KLCI was trading at 1,206.54 (down by 12% from 1,375.43). Now, wondering what is the target price now? Well, it's RM8.30, down from RM10.00 (down by 17%). Reasons quoted for the lowered target price are (a) downgrade in overall market price to earnings ratio following poor showing by incumbent government during the recent general election (b) a weaker outlook for the property sector as confidence in the sector will be eroded by political uncertainty and weak stock market performances, and (c) risks of additional taxes on the planters if government delays price increases on certain controlled items.

Note that the downgrade in target price was amongst others DUE TO WEAK STOCK MARKET PERFORMANCE. The price to earnings for IOI has been cut from 24 times to 20 times. In other words, at 24 times PE, the target price is RM10.00. At 20 times PE, the target price is RM8.30. What say you if you have heed the call and bought in at RM8.05? And interestingly, the buy call was also supported by CPO price uptrend and potential acquisitions.

On 18 April 2008, KLCI was trading at 1,267.82 (recovered slightly from the 11 March 2008's selldown). IOI has recovered to RM7.30. CIMB Research continued to yell a call with price target of RM8.20. Key supporting for the call are CPO price uptick and potential M&As.

On 29 May 2008, Dato' Yeo How, the group's executive director of finance and corporate affairs resigned. IOI was trading at RM7.10 and the price target is now RM8.40. Key share price triggers including rising CPO price and potential M&As. KLCI was trading at 1,261.82.

On 16 July 2008, the buy call that has been yelled all this while has been toned down to Neutral, meaning the stock's return is expected to be within +/- 5% of a relevant benchmark's total return. IOI is now trading at RM6.50 and the target price has now been revised down to RM7.80. Well, no more mention of rising CPO price... in less than a month's time. KLCI was trading at 1,119.42 (dropped by 11% from 29 May 2008's level)

Best part is on 18 July 2008 when IOI was trading at RM6.10 and KLCI was at 1,105.04 (further drop from 16 July 2008), CIMB has now downgraded the price from RM7.80 to RM6.50! One of the reason is CPO price to peak this year!!!! Key re rating catalysts are softening CPO price, lower crude oil price and higher than expected operating costs.

As you can see in the chart below, the CPO price was trading at above RM3,500 on 29 May 2008 and CIMB Research expects the CPO price to continue to rise. My big question is why is that within two months time, the target price has been cut by a huge RM2! As can be seen in the chart again, not only that the CPO price did not rise significantly but instead has started it's decreasing trend to about RM2,800 plus today.

I have always been a keen reader of CIMB Research's report. However, it just doesn't make any sense when buy and sell calls are made based on KLCI movement. When market is good, PE of 24 times are pegged but when market is trending down, PE was slashed to 20 times. So, what if naive uncle and auntie investors follow your call? Shouldn't your analyst is good enough to predict that CPO price is already peaking at RM3,500? Why is that your analyst still forecasted a rising CPO price when market was doing well but then talked about CPO price peaking when market is on downtrend? Would the price target stays at RM10.00 if market where to trade at above 1,300 level?

In the end, should we listen to you or not? Buy calls when market is good and sell calls when market is down. Any fundamentals? Sounds to me like your rationale was 'created' to justify your buy and sell call, depending on market movements rather than the other way round where you make the call based on fundamentals irregardless of market movements.

HDFIV Report Card @ 8 August 2008

Performance:

HDFIV is currently beating KLCI by 2.87% at a loss of 12.81% while KLCI suffered a loss of 15.69%. KLCI continued to be weighed down by slump in global economies as well as the political uncertainties in Malaysia.

Portfolio:

We have averaged out our cost in IOI Corporation Berhad via additional purchase of 1,400 units at RM4.88. Average cost has been brought down to RM5.63 from RM6.60. We continue to adopt the stance in accumulating this plantation stock which have been battered down from it's high for the year at RM8.60 (in 15 January 2008) - a decrease of 43%. 1 month and 3 months high were recorded at RM6.7 and RM7.65 respectively.

Asset Allocation:

Cash position dropped from 24% to 7% after our investment in IOI Corporation Berhad.

Strategy:

We have been taking a very contrarian approach so far with regards to our investments, especially in Bursa Malaysia Berhad and IOI Corporation Berhad. Research houses have been calling for a sell on these stocks and naturally the stock prices have reacted by trending downwards. We have been ignoring these calls and these calls are basically made on 12 months basis and have been very market-based. Check out a coming article on a recent analysis of a research house buy and sell call on IOI.

Wednesday, August 6, 2008

How to Fully Utilise a Bank's Products

A Chinese man walks into a bank in New York City and asks for the loan officer. He tells the loan officer that he is going to China on business for two weeks and needs to borrow $5,000.

The bank officer tells him that the bank will need some form of security for the loan, so the Chinese man hands over the keys to a new Ferrari parked on the street in front of the bank. He produces the title and everything checks out.

The Loan officer agrees to accept the car as collateral for the loan. The bank's president and its officers all enjoy a good laugh at the Chinese for using a $250,000 Ferrari as collateral against a $5,000 loan.

An employee of the bank then drives the Ferrari into the bank's underground garage and parks it there.

Two weeks later, the Chinese returns, repays the $5,000 and the interest, which comes to $15.41.

The loan officer says, 'Sir, we are very happy to have had your business, and this transaction has worked out very nicely, but we are a little puzzled. While you were away, we checked you out and found that you are a multi-millionaire. What puzzles us is why you would bother to borrow $5,000? The Chinese replies: 'Where else in New York City can I park my car for two weeks for only $15.41 and expect it to be there safely when I return.'

Friday, August 1, 2008

HDFIV Report Card @ 8 August 2008

Performance:

HDFIV is currently beating the KLCI 2.63% at at loss of 10.26% while KLCI suffered 12.89%. Dividend declared by both Bursa and Public Bank of 16.5% and 30.0% of par value respectively.

Porfolio:

No additions or disposals of stocks this week.

Cash position increased from 15% to 24% with monthly contribution.

Strategy:

Will continue to monitor prices of existing holdings for cost averaging.