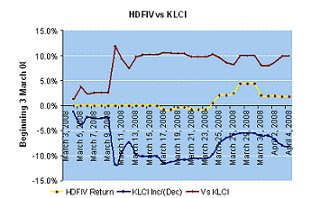

Kuala Lumpur Composite Index ("KLCI") decreased from 1,256.54 (28 March 2008) to 1,221.98 (4 April 2008), representing a decrease of 2.8%. Hengdai Equity Fund IV ("HDFIV")'s registered a return of RM101.94 or 1.78%, down from 4.39% in the previous week. Reason for the decrease is due to the lower valuation of Malayan Banking Berhad and a larger capital base in view of the new shareholders and as well as the impact from 2nd month's inflow of capital.

So far, HDFIV is beating KLCI by 9.94%, consistent with 9.76% a week ago.

Purchase

No purchases during the week.

Sell

No disposals during the week.

Asset Allocation

With additional capital coming from new shareholders and 2nd month's inflow of capital, equity allocation has decreased from 71% to 42%. We are again holding back a comfortable cash buffer of 58%. This comfortable cash buffer will allow us to snap up some cheap stocks that took some beatings during this week. Hapseng Plantations Berhad is currently in my radar as the stock plummeted to one year low of RM2.57 on 3 April 2008. The stock recovered some lost ground by closing at RM2.65 today.

With additional capital coming from new shareholders and 2nd month's inflow of capital, equity allocation has decreased from 71% to 42%. We are again holding back a comfortable cash buffer of 58%. This comfortable cash buffer will allow us to snap up some cheap stocks that took some beatings during this week. Hapseng Plantations Berhad is currently in my radar as the stock plummeted to one year low of RM2.57 on 3 April 2008. The stock recovered some lost ground by closing at RM2.65 today. Note: Asset allocation shows the three main categories that our money lies in. The main category which we are expected to invest in to make the return that we wanted is Equities. Secondly, Fixed Income is in the form of fixed deposits that provides stable but low return. This second category provides small return when the cash is yet to be utilised for investment. As there is a lock-in period for fixed deposit such as at least for two months (if the amount is less than RM5,000), there is a need to maintain cash in the form of 'pure' cash, which is the third category. The set back of holding 'pure' cash ("Cash") is that we do not earn any return at all.

No comments:

Post a Comment